The federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

Solar panel credit 2017.

You may be able to take a credit of 30 of your costs of qualified solar electric property and solar water heating property.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

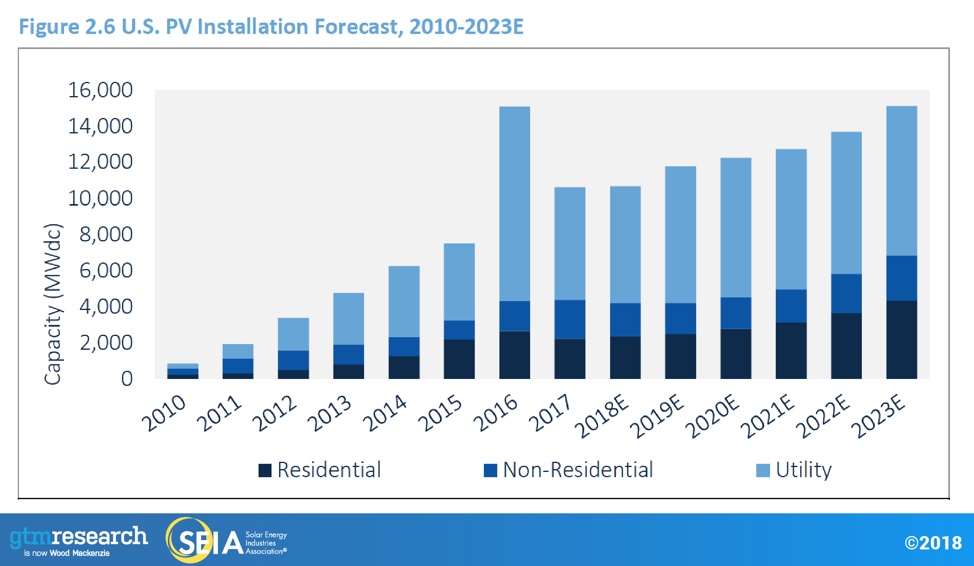

The itc applies to both residential and commercial systems and there is no cap on its value.

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

If you made energy saving improvements to more than one home that you used as a residence during 2017 enter the total of those costs on the applicable line s of form 5695.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc.

An average sized residential solar.

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines and fuel cell property.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

To claim the credit you must file irs form 5695 as part of your tax return.

Filing requirements for solar credits.

2018 extended the credit through december 2017.

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.