Plenty of solar companies like to quote the savings you ll generate on the hottest and longest days of the year.

Solar panels considered part of the house fixed assests.

Depreciation is an accounting term used to quantify the decline in value of an asset over its useful life.

2 golan s promissory note.

Solar energy systems are depreciable property just like land or buildings.

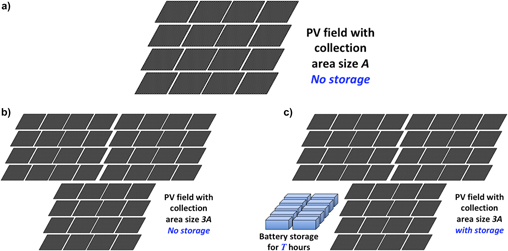

So folsom labs decided to run a few tests to see how walls compare to roofs for solar panel installation.

The output of a fixed tilt array on this specific roof.

Thursday jun 25 2020 congressional leaders call for solar specific solutions in economic recovery plans.

Electrical wiring of the solar panels is required to connect the solar panels with the power supply of the house or building.

In 2008 the itc was reauthorized and the cap was lifted.

48 is more favorable.

48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under sec.

The sale to golan was effected by.

Any property not expected to last more than a year is considered to be a business expense.

Let s take a look why this might be the case.

Solar panels are attached to the roof of a house or building.

25d does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property sec.

When buying a house one of the most important things you should be aware of is how to get a mortgage solar panels can affect your mortgage qualification process.

Solar renewable energy credits relate to the generation of solar renewable energy grants related to fixed assets should be taken into income over the depreciable lives of the fixed assets.

The related asset retirement cost capitalized as part of the related property plant or.

First enacted in 2005 as part of the energy policy act of 2005 the solar tax credit began as a tax credit of 30 percent of the cost to install a solar panel system with a maximum credit of 2 000.

The complexity of the rooftop provides very little space to fit modules.

If you re not buying your solar panels with cash the manufacturer may place a lien or uniform commercial code filing on your property to make sure you keep paying for them.

Once the solar panels were installed the utility company informed the host of eligible rebates which were then assigned to the llc.

And 4 a bill of sale and conveyance.

Says top 1 real estate agent thomas braunagel of bridgeport ct anybody can quote this super efficient july 15th but what really counts is when you average it out over the course of the year and this means factoring in the rainy months and.

The first comparison we wanted to make was the output of the wall mounted array vs.