The question of solar power panels is one that comes up increasingly and that will only increase as the logic of a cheaper power bill for tenants or in some cases the potential for a 0 bill is a common sense winner.

Solar panels on rental property capital allowances.

48 provides for a solar energy tax credit for the installation of solar panels as part of the general business credit under sec.

Also depending on when you re planning on selling the home and if it s a rental property it might be a while the solar panels might be ready to be replaced or a totally normal thing when you sell.

Solar panels are an enhancement to the property and are thus not claimable as a rental expense.

I can see subject to thresholds aia 100 should be available on solar panels bought by a trade.

25d does not allow a solar tax credit for the cost of installing solar panels for use in residential rental property sec.

Plant and machinery allowances pma.

Solar energy is something we have looked at many times ourselves.

A business may claim capital allowances if it carries on a qualifying business activity.

48 is more favorable.

Keep a note of the expenditure though as you can claim the cost as a deduction for capital gains tax purposes if the property is sold.

Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance first year allowances.

Solar panels for landlords.

If there are a lot more people who want solar trying to buy a home than there are homes with solar being sold it will sell for a premium.

This will impact on property owners considering solar power explains tax expert chris mattos.

Wear and tear allowance is not available for unfurnished lettings.

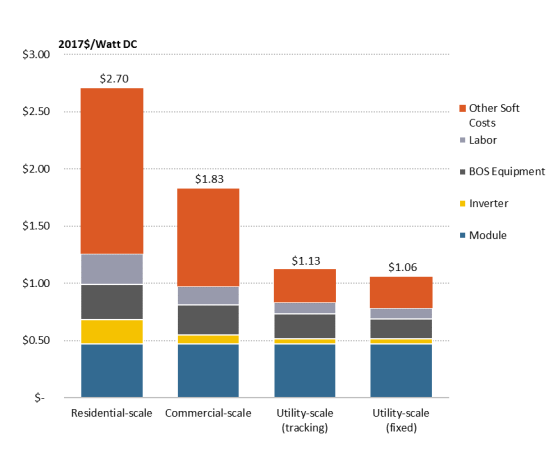

The costs of installing solar panels can be high but they do offer a generous payback over time.

Solar panels and capital allowances.

I m currently studying up on solar panels and capital allowances.

However i read on one accountants website if they are to be installed on a property used by a company but owned personally by the company s owners who do not charge rent for.

The capital allowance treatment of assets that facilitate the feed in tariff fit will change on 5 april 2012.

25d d 1 and 2 solar water heating panels and solar electric photovoltaic panels must be installed for use in a dwelling located in the united states and used as a residence by the taxpayer.

:max_bytes(150000):strip_icc()/GettyImages-1005470094-ad645adababd4fc2934628cead4c78ba.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1086691530-82d69e3d619b47a3883b0c71164a3260.jpg)

:max_bytes(150000):strip_icc()/irs-5bfc3189c9e77c00519bc228.jpg)

:max_bytes(150000):strip_icc()/Oilrigs-8b66c411d8db46ca80f307b992996098.jpg)